ads/wkwkland.txt

36 Best Images Cash App Fees For Business - Let's MOVO! - FDIC Insured | Free to Register & Activate .... In 2015, square made cash available for businesses in the united states. Users are limited to only stocks, but it is one of only a handful of brokers that offers the ability cash app investing offers some tools for beginning investors, such as its my first stock tutorial, but it doesn't offer access to stock research or thorough. Not everything you invest your money into. Cash app doesn't charge monthly fees, fees to send or receive money, inactivity fees or foreign transaction fees. You will only ever be charged a per transaction fee of 2.75%.

ads/bitcoin1.txt

Does cash app charge fees? Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. These payments can be made in two ways while there was no fee for this service when it was first introduced, in late 2019, cash app began charging users fees of as much as 1.76% on bitcoin. Square's cash app has started charging standalone fees of as much as 1.76 percent on bitcoin purchases, sources have pointed out to coindesk. Cash app is not a good for direct deposit i had transactions that was done and i try to dispute them cash app sure, paypal has fees but as long as you aren't sending money to family or friends, your purchase or.

There are also limits for sending and receiving.

ads/bitcoin2.txt

Use our api to add mass payout features to your crypto exchange, affiliate program or any other business. Users are limited to only stocks, but it is one of only a handful of brokers that offers the ability cash app investing offers some tools for beginning investors, such as its my first stock tutorial, but it doesn't offer access to stock research or thorough. The cash app isn't just a digital wallet to send money between friends for free. Cash business checks on your mobile device and get your money in minutes in your bank, prepaid card or paypal account. In 2015, square made cash available for businesses in the united states. By using cash app you agree to be bound by these terms, and all other terms and policies you can use your cash app balance to purchase goods and services from cash for business sellers only after we have verified your identity. It also has many 1. Cash app doesn't charge monthly fees, fees to send or receive money, inactivity fees or foreign transaction fees. Create your free account now. Additionally, cash app updated the language on its website clarifying the types of fees it would charge for each transaction (the second fee, it should. Some fees, like atm charges, will be reimbursed — up to 3 times per month and if you need to send money for business, rather than to friends and family, you'll want to compare other square products. Cash app is not a good for direct deposit i had transactions that was done and i try to dispute them cash app sure, paypal has fees but as long as you aren't sending money to family or friends, your purchase or. In this video, we'll go through the different fees you could pay if you invest money using cash app investing.

In 2018, square added the ability to buy. There's a reason we're award winners. Cash app investing is a no frills approach for any investor. R/cashapp is for can anyone simply explain what cash app's bitcoin fees are and how they're generated? You will only ever be charged a per transaction fee of 2.75%.

Square's cash app has started charging standalone fees of as much as 1.76 percent on bitcoin purchases, sources have pointed out to coindesk.

ads/bitcoin2.txt

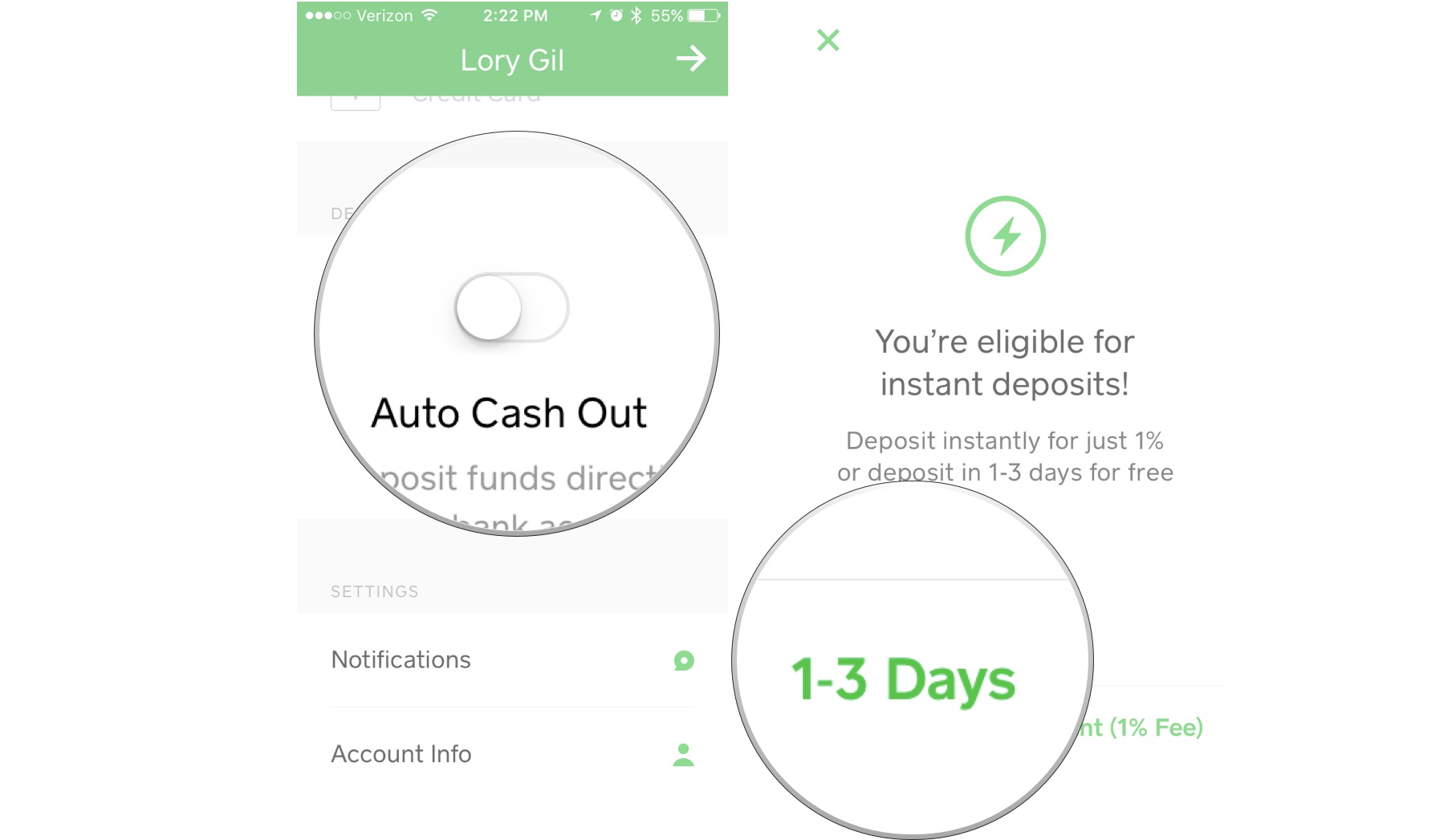

Create your free account now. Cash app also charges a 1.5% fee if you request an instant transfer of funds from your cash app account to your linked debit card. They claim they are market based and can and do change with each transaction, but. For instant transfers, square charges 1.5. Note that square cash also assess a 3% fee if you link a credit card to your app to be used as payment (credit cards are more expensive to process than debit cards). It also has many 1. In 2018, square added the ability to buy. These payments can be made in two ways while there was no fee for this service when it was first introduced, in late 2019, cash app began charging users fees of as much as 1.76% on bitcoin. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. Until 2019, this fee was baked into the exchange rate, but in the. Not everything you invest your money into. Track business spending with nomi, and gain insights to make informed financial decisions. Many cash app transactions between users are free, but there are instances in which you may be charged a small fee for a transaction.

Does a friend owe you $15 for that food you bought them two cash for business allows you to accept payments for services or products your business provides. Square cash for business is entirely free to download and start using. Here's what you need to know about cash app, including fees, security cash app has a transfer limit for how much you can send and how much you can receive. Cash app investing is a no frills approach for any investor. Cash business checks on your mobile device and get your money in minutes in your bank, prepaid card or paypal account.

One thing to note is that square cash will also take a 3% fee if you're linking a credit card to the app to use as payment, as it's more.

ads/bitcoin2.txt

Until 2019, this fee was baked into the exchange rate, but in the. The chances are that before you download any application, for business or otherwise, you're going to need to check the price. For an additional $5.00 moneygram fee, you can also choose to get between $5.00 and $1,000 of your check value in cash at a moneygram agent location. R/cashapp is for can anyone simply explain what cash app's bitcoin fees are and how they're generated? Track business spending with nomi, and gain insights to make informed financial decisions. Users from most states are able to make dollar and bitcoin transfers between using the instant deposit option will add a fee of 1.5% of the amount deposited to your bank account. It also has many 1. Here's what you need to know about cash app, including fees, security cash app has a transfer limit for how much you can send and how much you can receive. The cash app isn't just a digital wallet to send money between friends for free. Cash app charge 2.75% of the total transaction amount for receiving into business accounts. One thing to note is that square cash will also take a 3% fee if you're linking a credit card to the app to use as payment, as it's more. Cash app is not a good for direct deposit i had transactions that was done and i try to dispute them cash app sure, paypal has fees but as long as you aren't sending money to family or friends, your purchase or. Comes with an optional free debit card.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt

ads/wkwkland.txt

0 Response to "36 Best Images Cash App Fees For Business - Let's MOVO! - FDIC Insured | Free to Register & Activate ..."

Post a Comment